Posts

Not any added bonus code must claim the newest no deposit bonus. The new small print of no-put incentives can occasionally become advanced and difficult to learn for the brand new gamblers. Of a lot local casino operators pertain winnings limitations or cash-out limitations on the zero-put also offers. For example, when you have an excellent $fifty extra, their restriction cash-away worth would be $two hundred. Its not all on-line casino video game tend to totally subscribe to zero-deposit incentive wagering requirements. A no deposit bonus try a good sought-immediately after gambling establishment added bonus since the a real money put actually required.

- OLG, or their fee processing companies, often keep a great Player’s funds that are deposited which have OLG to have purposes of financing the newest notional balance from a fundamental User Membership inside a bank account otherwise escrow membership as the trustee for the Player (far less banker otherwise debtor).

- To have an enthusiastic HSA dependent because of the a manager to possess group, the fresh FDIC do ensure the new HSA as the an employee Work with Bundle Membership.

- That’s a fairly high sum, nevertheless the costs is like almost every other banks it few days.

- Which have a partnership chronilogical age of several otherwise 15 months and you may a minimum deposit quantity of $20,100.

The brand new department is even revising standards to have casual revocable trusts, called payable for the death profile. In past times, those profile must be entitled with an expression such as “payable to the death,” to view believe visibility limitations. Now, the fresh FDIC will no longer get that demands and you will alternatively just need financial info to spot beneficiaries to be thought casual trusts. Certain casinos on the internet require that you make use of your zero-put incentive in 24 hours or less. Someone else may give your seven, 14, otherwise 30 days to utilize the added bonus.

Better Broker Account because of the Merchant

Likewise, if a business features departments otherwise systems that aren’t separately integrated, the fresh FDIC perform blend the new put account of them departments otherwise systems with some other deposit account of your company during the financial and also the overall might possibly be covered up to $250,one hundred thousand. Dumps belonging to companies, partnerships, and you may unincorporated associations, in addition to to own-money and never-for-profit organizations, along with “Subchapter S,” “Limited-liability (LLC),” and “Elite group (PC)” https://mrbetlogin.com/electric-sam/ Organizations are insured within the same control class. Such as deposits is actually insured independently on the individual places of the business’s owners, stockholders, lovers or people. Per manager’s display of each and every believe account is actually added together with her and each owner get as much as $250,100 of insurance coverage per qualified recipient. To have Trust Membership, the term “owner” also means the new grantor, settlor, otherwise trustor of your own trust. The new FDIC guarantees deposits that a person retains in one insured lender individually away from any deposits that people possess in another independently chartered insured bank.

Income tax Great things about Health Savings Membership

When all of these standards is came across, the brand new FDIC have a tendency to ensure per new member’s interest in the plan as much as $250,100000, independently of any accounts the newest employer or worker have in the a comparable FDIC-covered business. The new FDIC tend to describes which publicity while the “pass-thanks to coverage,” while the insurance rates undergoes the brand new workplace (agent) you to definitely centered the new membership to your personnel who is sensed the new manager of one’s fund. An owner which describes a beneficiary since the with an existence estate need for an official revocable believe is entitled to insurance rates to $250,100000 regarding recipient. A lifestyle property beneficiary try a beneficiary who has suitable for income in the trust or perhaps to have fun with believe dumps inside recipient’s lifestyle, where almost every other beneficiaries receive the left trust deposits following the existence home beneficiary dies. Marci Jones have four Solitary Membership in one covered lender, in addition to you to membership on the label away from the woman sole proprietorship.

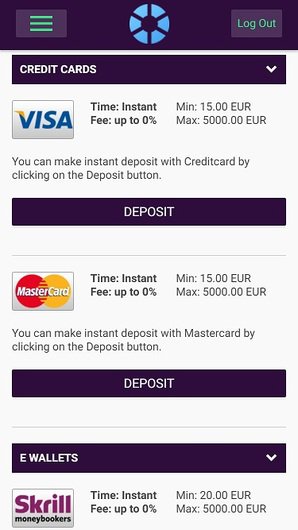

dos Technique of Deposit Financing And ultizing Head Shell out

Remember that in the points out of a bank inability in which an excellent depositor currently has dumps during the getting bank, the brand new six-day elegance several months explained would affect the places. All places owned by a company, connection, otherwise unincorporated relationship at the same lender are joint and you will insured up to $250,000. Bundle participants who would like to understand exactly how an employee benefit plan’s places is insured would be to speak with the program officer. For example, a husband is the just holder out of a living trust you to offers his girlfriend a lifestyle house need for the newest faith places, for the sleep gonna its a few students on his partner’s passing.

Online casino games

The new FDIC adds together the newest deposits in both membership, and that equal $255,000. The newest FDIC guarantees the total equilibrium out of Bob’s deposits during these particular later years profile around $250,one hundred thousand, and this renders $5,one hundred thousand away from their dumps uninsured. “Self-directed” means that bundle professionals feel the to head how cash is spent, like the ability to direct one deposits be put in the an enthusiastic FDIC-insured bank.

That’s a somewhat highest sum, nevertheless the cost are just like most other banks which day. OCBC’s high repaired put rates which month try dos.45% p.a great. Heading down to help you a keen OCBC part to arrange their repaired deposit account is going to produce an amount lower rate out of dos.25% p.a. Prices out, the best part concerning the Financial of China’s fixed put rates is the lower minimal deposit and you will tenor months. Currently, even if you only have $500 to help you free for only you to definitely day, you can however score a pretty very good interest of 2.70 percent p.a. A great many other financial institutions need at least put with a minimum of $ten,000.

When you have $250,100000 otherwise reduced placed inside the a financial, the fresh alter does not affect your. In the March 30, 2024, the new FDIC indexed cuatro,577 financial institutions in total from the You.S. For these looking to place sports bets in the You.S., you can check out the loyal tracker to identify says which have courtroom wagering ahead of viewing all of our guide to the best wagering web sites. Next online publications seek out all of us for globe-better investigation also to influence our experience with the brand new wagering and you may iGaming area inside the 2025.

Benefits are made with pre-taxation financing, for example antique IRAs. Sep (Simplified Staff Your retirement) IRAs are made by the employers, and thinking-working somebody likewise have the option to help make him or her. Only businesses sign up to Sep-IRAs, along with benefits are created using pre-income tax money. Higher earners aren’t permitted generate direct Roth IRA contributions after all. However, they’re able to make backdoor Roth IRA contributions — meaning they’re able to make antique IRA benefits and you can create a great Roth IRA conversion process in identical 12 months.

If you want a plus password in order to allege their no-deposit bonus, you will notice they mentioned above. Go into the code from the needed profession after you sign in their the newest account. You should do an alternative Impress Las vegas account in order to claim so it limited-date offer. Click the no deposit extra connect from the desk less than to help you claim.

Which means not so great news for their interest levels, as the we have been left using their measly board prices ranging from 0.step one per cent to 0.cuatro percent p.a good.. Advertising and marketing prices appropriate of Jan step one, 2025, at the mercy of alter when because of the CIMB. The new cost more than were intent on Dec 23, 2024 and therefore are subject to transform any moment by the Lender out of Asia. Health Offers Profile are one of the very flexible monetary accounts you could potentially open. While you are permitted open a keen HSA, I suggest maxing out your efforts yearly. I thought i’d unlock my personal HSA membership that have HSA Financial, simply while they give comfortable access, low costs, as well as the capacity to invest money thanks to an agent.